how much are payroll taxes in colorado

Browse Get Results Instantly. Ad Payroll So Easy You Can Set It Up Run It Yourself.

How To Read Your W 2 University Of Colorado

If youve already filed your Colorado state income tax.

. Use ADPs Colorado Paycheck Calculator to estimate net or. Get a Demo Today. Colorado Wage Base.

It simply refers to the Medicare and Social Security taxes employees and employers have to. The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for. Filing Frequency Due Dates.

TAXES 21-16 Colorado State Income Tax Withholding. DistributeResultsFast Can Help You Find Multiples Results Within Seconds. The median household income is 69117 2017.

State income tax is a flat rate of 455 no state-level payroll tax no state-level. A new employer in Colorado would have these additional payroll tax. Payroll tax is 153 of an employees gross.

What percentage is payroll taxes. 17000 for 2022 Colorado SUI rates range from. How to File Online.

What percentage is payroll taxes. Each tax type has specific requirements regarding how you are able to pay. All Services Backed by Tax Guarantee.

075 to 1039 for. Whose tax payments may increase. Payroll tax is 153 of an employees gross.

Employers who pay more than 50000 withholding tax per year are required to pay by. Colorado Cash Back. High wage earners above 200000 have to pay whats called the Additional.

Ad See How Papaya Can Help You Automate Your Global Payroll or PEO. The state income tax rate in Colorado is a flat rate of 455. FAQs About Colorado Payroll Taxes Does Colorado Have State Income Tax.

Colorado Payroll taxesSubtractions Any interest or investment income from US. A state standard deduction exists. Do you make more than 400000 per.

Ad Search For Info About Colorado payroll taxes. Colorado income tax rate.

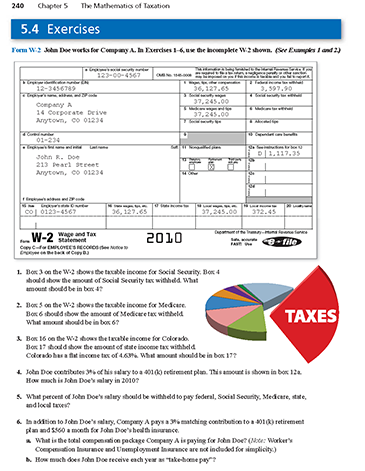

Math You 5 4 Social Security Payroll Taxes Page 240

State W 4 Form Detailed Withholding Forms By State Chart

Colorado Issues New Employee Withholding Certificate For 2022

Colorado Tax Rates Rankings Colorado Tax Rates Tax Foundation

The Complete Guide To Colorado State Taxes 2022

Here S How Much Money You Take Home From A 75 000 Salary

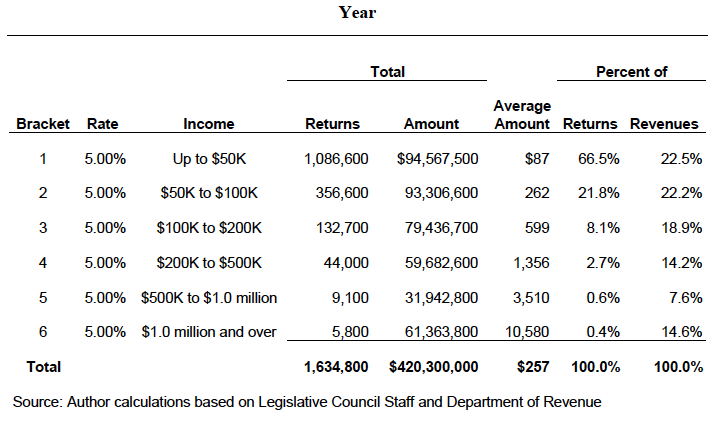

Tax Policy And The Colorado Economy Common Sense Institute

Colorado Tax Law Update 2022 John R Dundon Ii Enrolled Agent

Quickbooks Payroll Pay Employees File Taxes Easily Quickbooks Help Training Denver Colorado Peak Advisers

State Income Tax Rates And Brackets 2021 Tax Foundation

Colorado Tax Rates Rankings Colorado Tax Rates Tax Foundation

Another Income Tax Cut For Colorado In 2022 Maybe And It Could Cost The State Budget 400 Million Colorado Public Radio

Colorado Sales Tax Small Business Guide Truic

Tax Resolutions In Colorado 20 20 Tax Resolution

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Payroll Software Solution For Colorado Small Business

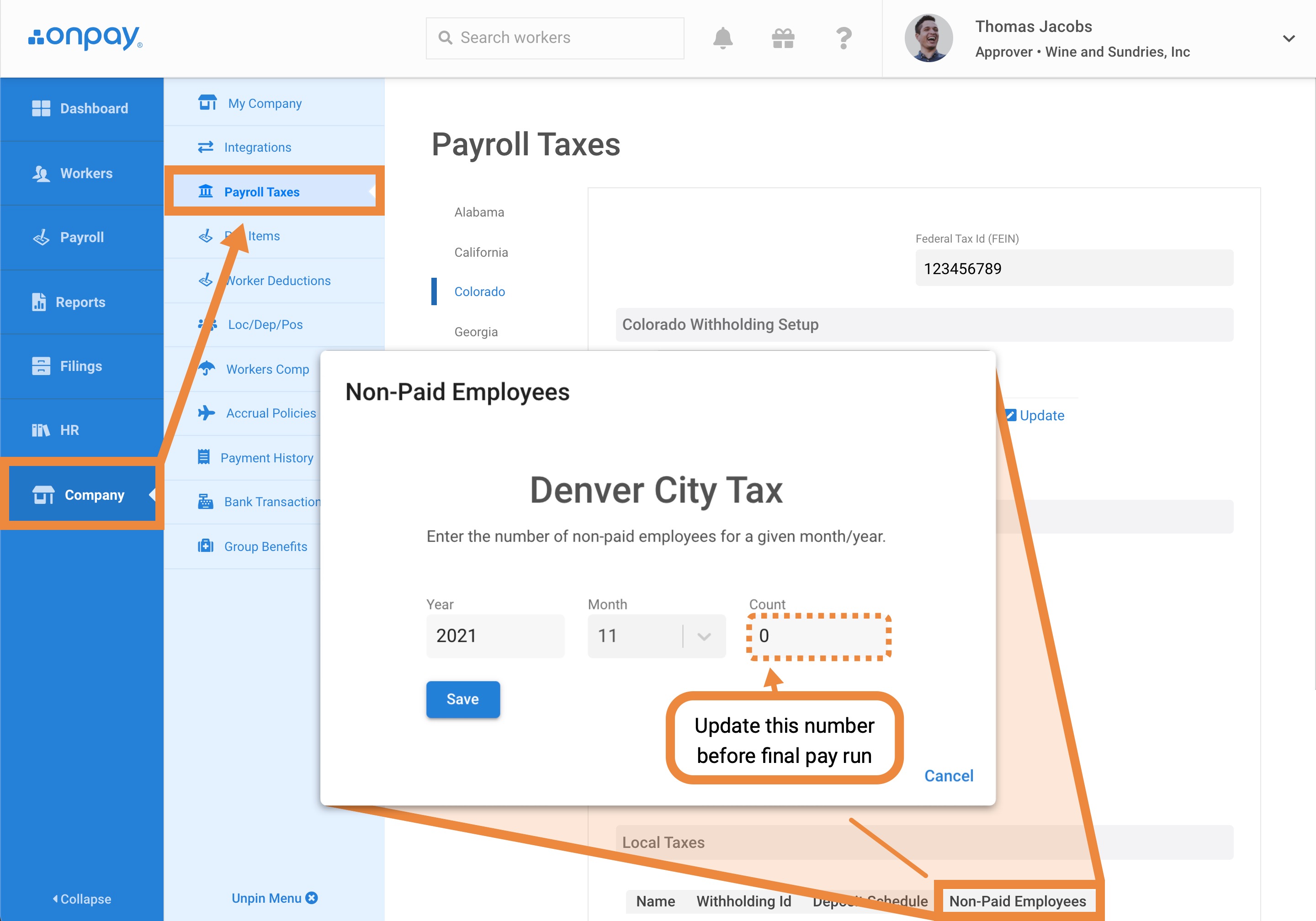

Colorado Occupational Privilege Taxes Help Center Home

Taxes In Colorado Springs Living Colorado Springs

What Is The Cost Of Living In Colorado Vs California Taxes Housing More Upgraded Home